An exceptional decision becoming almost routine

For the second consecutive year, France had to adopt a special budgetary law to prevent a state shutdown. Presented at the Council of Ministers on December 22, and unanimously adopted by the National Assembly and the Senate on December 23, this law allows the state to continue functioning without a budget passed for the upcoming year.

At first glance, everything seems under control: salaries will be paid, hospitals will continue to operate, and administrations will remain open. Yet behind this technical measure lies a far more worrying reality: the repeated inability of the French political system to pass a budget, which is a fundamental act of democracy.

This special law is not a minor administrative detail. It is a symptom of a deep crisis—political, institutional, economic, and social. It reveals a state that no longer governs through clear choices, but through emergency measures, amid growing debt, deficits, and social tensions.

1. What is a special law?

Normally, every year Parliament passes:

-

a Finance Law (the State budget),

-

and a Social Security Financing Law.

These texts authorize the state to:

-

collect taxes,

-

spend public money,

-

finance public policies.

When no budget is passed on time, the state legally cannot spend after January 1. To avoid this, an exceptional solution exists: the special law, provided for in Article 45 of the Organic Law on Finance Laws (LOLF).

This law allows:

-

the temporary opening of credits,

-

within the limits of the previous year’s budget,

-

solely to ensure the continuity of public services.

It is not a real budget. It is a survival measure.

2. A second consecutive year: why it matters

In December 2024, after the fall of Michel Barnier’s government, France had already had to resort to a special law to ensure budget continuity. At the time, it was presented as an exceptional situation linked to a political crisis.

A year later, in December 2025, the scenario repeats. This time, it is not the government’s fall that is at fault, but the total failure of parliamentary negotiations over the 2026 budget.

Two special laws in two years is no longer an accident.

It is a lasting dysfunction.

In a stable democracy, the budget is passed, even under difficult circumstances. Here, the system can no longer produce a compromise. The special law thus becomes a circumvention tool, allowing the state to function without making real decisions.

3. What blocked the 2026 budget

The 2026 budget was not rejected by a clear vote. It failed because:

-

the government lacks a solid majority,

-

the National Assembly and the Senate have opposing views,

-

no lasting compromise was found.

The National Assembly wanted to maintain or increase certain public expenditures, particularly social programs. The Senate, mostly right-leaning, opposed any additional taxes.

The joint committee, tasked with finding an agreement between deputies and senators, failed. Facing this deadlock, the government opted for the special law to avoid an immediate crisis.

4. A unanimous vote… but by default

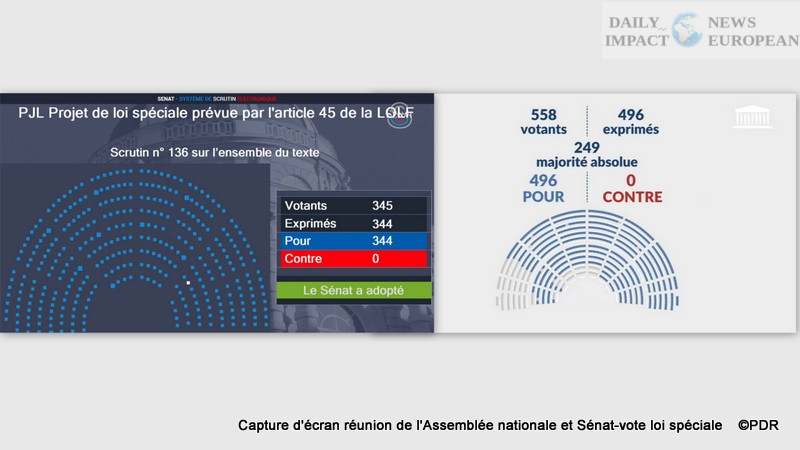

On December 23, the special law was adopted unanimously:

-

496 votes in the National Assembly,

-

344 votes in the Senate.

This overwhelming vote may give the impression of political consensus. In reality, it is a forced consensus. No party wanted to be held responsible for a state shutdown on January 1.

Voting against would have meant:

-

blocking salary payments,

-

paralyzing public services,

-

causing a major institutional crisis.

The special law was therefore passed out of absolute necessity, not conviction.

5. Shift in power tools: from 49.3 to the special law

For years, the preferred tool to pass budgets was Article 49.3 of the Constitution, allowing the government to adopt a text without a vote, except for a motion of censure.

Today, the government uses 49.3 less frequently, as it is politically conflictual, and relies more on technical tools like the special law.

This shift is revealing:

49.3 assumed the power struggle,

the special law exposes an inability to decide.

The state no longer makes decisions—it postpones them.

6. A broader political crisis

This situation reflects a lasting political crisis:

-

fragile governments,

-

unstable majorities,

-

degraded parliamentary dialogue.

The Fifth Republic, designed for stability, shows its limits when the executive cannot secure a clear majority. The result is stop-and-go governance, made of temporary compromises and emergency solutions.

7. Economic context: a harsher reality than official discourse

While institutions are gridlocked, the economic situation deteriorates.

Unemployment

The government often praises the decline in unemployment since 2020. Official figures show improvement, but the reality is more nuanced:

-

over 6 million people are jobless,

-

nearly 7.5 million if including RSA beneficiaries,

-

nearly a quarter of the active population.

Since late 2023, unemployment has been rising again.

Poverty

Nearly 16% of the population lives below the poverty line, an unprecedented level in decades. About 40% of the unemployed are poor.

As noted by Élucid Media’s 2025 economic review, France faces a fragile situation, with weak growth and high real unemployment.

8. Deindustrialization and trade deficit

France suffers from a trade deficit exceeding €100 billion annually, including around €60 billion in industrial trade excluding energy.

Despite rhetoric about reindustrialization, industrial production remains over 10% below its 2007 level, resulting in:

-

fewer industrial jobs,

-

fewer revenues,

-

greater external dependency.

Impact European had already highlighted this as a structural problem, not just a budgetary one.

9. Public debt: the core issue

France’s public debt stands at approximately €3.4 trillion, or nearly €100,000 per household.

Over 50% is held by foreign investors, making the country vulnerable to a loss of market confidence.

With interest rates around 3.5%, debt service could reach nearly €100 billion per year by the end of the presidential term.

According to Impact European, this debt accumulation is a direct consequence of structural drift and lack of reforms, undermining all public finances.

10. High taxation, contested results

France is among the highest-taxed countries globally, with the top 10% bearing over half of the tax burden. Yet:

-

debt keeps rising,

-

public services deteriorate,

-

investments are lacking.

This fuels a sense of inefficiency and encourages the exodus of entrepreneurs and capital.

11. Public services on the front line

Given rising debt and constrained spending (interest, defense), budget adjustments will likely target:

-

education,

-

health,

-

justice,

-

security.

The special law, by limiting credits to the bare minimum, already signals this logic of restriction.

Impact European’s article on debt and the economic impasse shows how these restrictions are structural, not just temporary.

12. What to expect in 2026?

In January 2026, budget debates are set to resume. Several scenarios are possible:

-

a fragile compromise,

-

another deadlock,

-

a return to 49.3,

-

even a government censure.

None of these scenarios provide lasting stability.

As noted in a previous Impact European article, the current budget blockages are a symptom of deep structural issues, which cannot be solved by simple special laws.

Democracy on budget life support

The special law adopted in December 2025 prevented an immediate crisis. But it solves nothing. It confirms a worrying trend: the French state now governs in permanent emergency mode.

Two consecutive years without a timely budget is not trivial. It is a sign of a system at its limit, unable to make clear decisions under heavy economic constraints.

Without deep reform of political and budgetary operations, the special law risks becoming the norm, rather than the exception.

©2025 – IMPACT EUROPEAN

Views: 1

More Stories

Phenom 300E: The World’s Leading Light Jet for 14 Consecutive Years

Art Capital, 20 Years Already

Chers Parents Premieres in Paris